JP Morgan Chase CEO Jamie Dimon visits West Philadelphia

Media Outlet

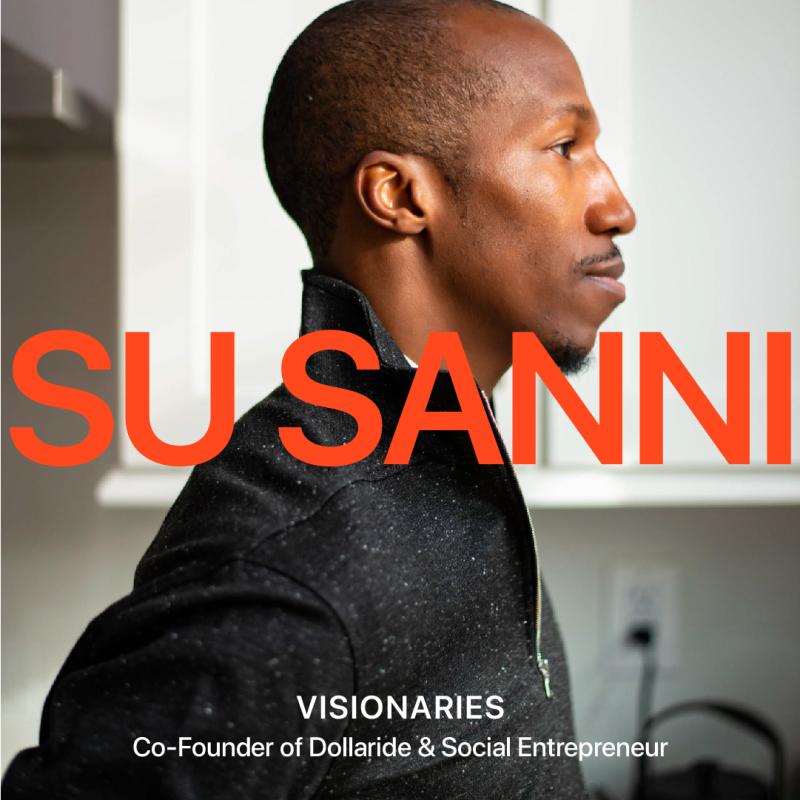

Stephen Williams

Khaliff Young, a longtime Philadelphia resident, spoke about buying the house his family rented in South Philadelphia for 25 years with the help of a loan officer .

“She spoke to me in language that I could understand,” Young said of Tanyika Rickard, the lending officer at a Chase branch near 52nd and Market streets. “She made the process pleasant.”

Young made his comments at the grand opening of the Chase Community Branch on Thursday in the community room of the bank, as part of a panel discussion with Chandra Williams, Chase Community Manager and Della Clarke, president of the Enterprise Center, a non-profit in West Philadelphia that assists small businesses.

Jamie Dimon, CEO of JP Morgan Chase, said listening to Young’s story and what happens in the branches that are making mortgages to community people and loans to small businesses what is “most fun” about banking.

“People look at JP Morgan Chase as this hard, faceless nameless corporation with some CEO up in a corner office making all the decisions,” Dimon said. “At the end of the day, corporations are local. What we want is mortgages to reverse the redlining that’s been taking place here for years.”

The grand opening was attended by Chase executives, community leaders and elected officials including Mayor Jim Kenney, U.S. Rep. Dwight Evans, D-3rd District; state Sen. Vincent Hughes, D-7th District; Robert Bogle, CEO/president of The Philadelphia Tribune; Jennifer Roberts, Chase CEO of Consumer Banking and Marcus White, Chase vice president and branch manager.

“We are grateful to have JP Morgan Chase as an incredible partner in our work to invest in the growth of Philadelphia’s communities,” Kenney said.

In addition to banking services such as taking deposits, cashing checks and making loans, the Chase Community Branch has classes on financial literacy and how to run a small business.

In addition, the bank offers free WiFi and a multipurpose room for community events. Other classes include budgeting, credit management, home ownership and personal investing. All of the classes and services are free of charge.

For small businesses, the branch, which opened in 2022, also offers services such as bookkeeping, mentorship, marketing along with introductions to accountants, lawyers and social media managers.

In an interview after the event, Dimon said the concept of the community bank branches is part of the company’s $30 billion commitment to invest and promote economic growth and opportunity in Black and brown communities nationwide by 2025.

Chase, like other corporations, had several programs designed to do more business in underserved Black and brown neighborhoods, but after the 2020 murder of George Floyd by a Minneapolis police officer, the bank’s executive team realized it wasn’t enough.

“The thinking that came out of that was we have to do more,” Dimon said. “We came together and we formulated a plan. Part of that plan was the community branches.”

But the Chase Plan also calls for more spending for home loans, building affordable housing, mortgage refinancing, investing community banks in under served areas and providing small business loans.

But Dimon said the schools and government have a part to play in making mortgages more accessible.

For example, renters should be able to have their on-time payments be a part of their credit score, he said.

Federal regulators have said they are working on this and other proposals.

And financial literacy should be taught in all K-12 schools, Dimon said.

The Philadelphia branch is one of about 15 branch/community centers Chase has opened in underserved neighborhoods in Akron, Baltimore, Boston, Chicago, Dallas, Detroit, Houston, Los Angeles, Minnesota, Miami, New Orleans, Oakland and Washington, D.C.

Since 2021, under Chase Community Manager Chandra Williams’ leadership, the bank has hosted more than 175 financial health events in the Philadelphia region; held more than a dozen workshops; and its free community space is booked through June.

The West Philadelphia branch offers a $5,000 grant for homebuyers seeking mortgages in Black, Hispanic or Latino communities; and offers a $2,000 purchase closing benefit for veterans.

Since it opened, the Chase branch has reported a 20% increase in secure checking accounts, compared with traditional branches; a 50% rise in business credit card accounts; and is seeking to hire an additional 800 people in the Philadelphia area, for jobs paying $22.50 an hour.

The branch on 52nd Street is well known to the neighborhood, having been home to the iconic Philadelphia Savings Fund Society (PSFS) bank for many years, which later became Citizens Bank.

Chase, which has served the greater Philadelphia area since 2018, has 4,700 branches nationwide.

The company has plans to open about 80 branches throughout the region by 2024.

In December 2021, JP Morgan Chase reported $48.3 billion in profit or $15.36 a share. It reported $3.1 trillion in total assets under management. Based in New York, Chase is one of the largest and oldest financial institutions in the U.S.

According to Dimon, the concept has worked so well, Chase has hired an additional 120 community managers to operate out of its traditional branches.

“Philadelphia, Delaware and South Jersey is a huge market,” Dimon said. “As our company grows in this region, we’re committed to providing greater economic opportunity for more residents, especially for underserved populations.”