Philly nonprofit to help small businesses buy property

Media Outlet

Kristen Mosbrucker

The Enterprise Center, a Philadelphia-based nonprofit organization that helps promote small business development, has a new $500,000 revolving loan pool for minority owned companies.

The goal is to increase building ownership along commercial corridors — which enables small businesses to build equity instead of renting, and helps stabilize neighborhoods.

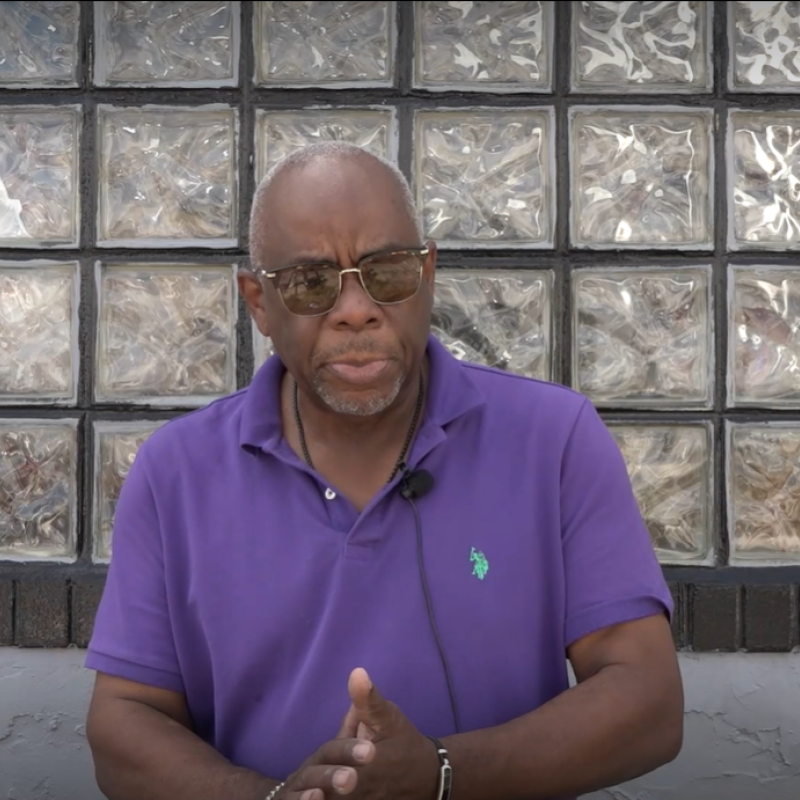

“One of the biggest pain points is lack of capital,” said Della Clark, president and CEO of The Enterprise Center.

The short-term loans will cover up to 75% of business expenses related to due diligence. That includes things like attorney fees, closing costs, or even building appraisals.

The Enterprise Center also runs a Community Development Financial Institution which connects small businesses with financing options, like a Small Business Administration-backed loan. But there are closing costs associated with building purchases that can add up.

“If they have any kind of dollars saved up to acquire their building, we want them to keep that and use our funds for the due diligence to make that decision,” Clark said.

As interest rates for loans remain higher than in recent years and the economy slows down, it’s more expensive and riskier than ever for a small business to borrow, according to Clark.

“You can’t go to a bank because a bank makes primarily asset-based financing,” she said. “And most minorities have very little assets for collateralization of a loan.”

As businesses repay the nonprofit’s short-term, low interest loans, the pool would be replenished. If the small business doesn’t purchase a building or make capital improvements after a year, the loan will be converted into a three-year note with a 3.5% interest rate.

The Enterprise Center was tapped last year to distribute $1 million to revitalize the 52nd Street business corridor in West Philadelphia.

“When you own your building, you go out and sweep every day,” Clark said. “If you have to depend on a landlord for repairs, oftentimes they do not happen as quickly as you would like to. And it impacts your sales.”

The nonprofit organization expects to make about 30 loans every year.